-

In the realm of DeFi development services, cross-chain technology plays a pivotal role in transcending the constraints of conventional single-chain DeFi systems. It facilitates interoperability between different blockchain networks, allowing seamless asset transfer and data sharing. Utilizing multiple chains enhances scalability, reducing congestion and transaction fees.

Moreover, the emerging concept enables asset diversification by accepting collateral from various blockchains. This technology's ability to bridge the gap between different networks unlocks new levels of efficiency, liquidity, and innovation within the DeFi ecosystem.

Limitations of Regular DeFi

Traditional DeFi platforms operate within the confines of a single blockchain network. While these platforms have demonstrated remarkable innovation, they face scalability and interoperability challenges.

Transactions become congested, fees spike, and accessing assets across different chains requires complex and time-consuming processes. These limitations hinder the DeFi ecosystem from reaching its full potential.

Suggested Read | Emerging DeFi Trends in 2023: Shaping the Future of Fintech

Cross-Chain DeFi Technology

Cross-chain DeFi technology addresses these limitations by enabling seamless communication and value transfer between different blockchain networks. This approach allows users to access and utilize assets across various chains while retaining the security and features of each underlying blockchain. Cross-chain DeFi technology can revolutionize the DeFi landscape through interoperable protocols and bridging mechanisms.

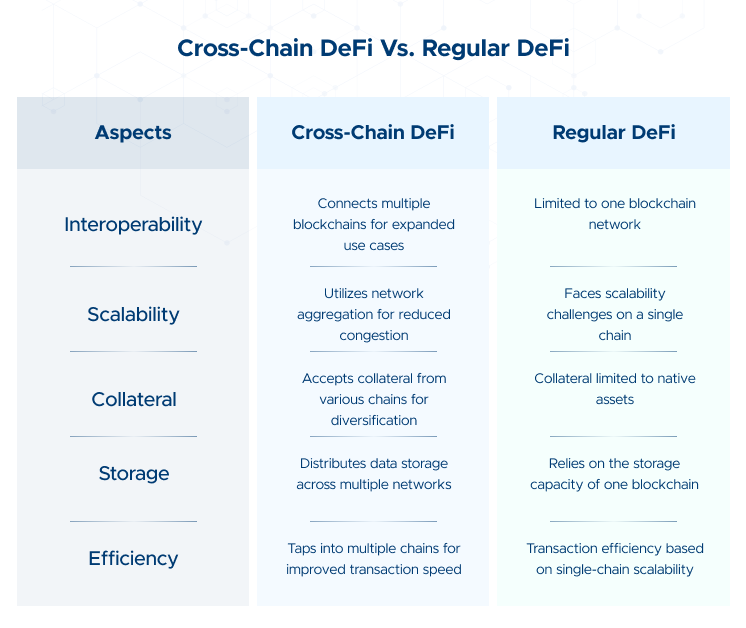

Here is a comparative analysis between cross-chain DeFi and regular DeFi:

Also, Discover | Cross-chain DeFi Development: Ensuring Interoperability

The Working of Cross-Chain DeFi Technology

Cross-chain technology in DeFi operates as a bridge between different blockchain networks, enabling seamless interoperability and asset movement. At its core, this technology establishes communication protocols and mechanisms that allow blockchain networks to share information and value securely and trustlessly.

The process begins with the creation of wrapped or synthetic assets on one blockchain that represent the same value as an asset on another blockchain. These wrapped assets are locked on their native chain, and their corresponding value is minted on the target chain. It ensures a one-to-one peg between the assets on different chains.

Smart contracts play a pivotal role in facilitating cross-chain transactions. These contracts validate the locking of assets on one chain and the minting of corresponding assets on another chain. Through these smart contracts, users can seamlessly transfer assets from one chain to another and utilize DeFi applications on different networks.

Moreover, decentralized oracles provide real-time information about the state of assets on both chains, ensuring accurate conversions and maintaining the pegged value. Security mechanisms are also in place to prevent fraudulent or malicious activities during the transfer process.

Essentially, cross-chain technology enhances DeFi by breaking down the barriers between isolated blockchain networks. It enables users to access a wider range of assets, liquidity, and services across the decentralized finance ecosystem.

Check It Out | Cross-Chain NFT Marketplace: A Beginner’s Guide

Benefits of Cross-Chain DeFi Technology

Cross-chain DeFi technology offers a multitude of benefits that enhance the decentralized finance landscape by overcoming traditional limitations and unlocking new opportunities:

Interoperability and Asset Mobility

Cross-chain DeFi allows assets to move seamlessly between different blockchain networks. It enhances interoperability and enables users to access various assets and services across different chains without complex and time-consuming processes.

Enhanced Scalability

Traditional DeFi platforms often face congestion and high transaction fees during peak demand. Cross-chain technology mitigates these challenges by leveraging multiple chains to distribute transactions, improving scalability and reducing congestion.

Diversified Collateral

In single-chain DeFi, collateral is often restricted to the native assets of that chain. Cross-chain DeFi enables collateral usage from various blockchains, enhancing diversification and risk management strategies.

Enhanced Security and Transparency

Smart contracts and decentralized oracles ensure the security and transparency of cross-chain transactions. The real-time data verification provided by Oracles enhances the integrity of asset conversions and maintains accurate pegged values.

New Use Cases and Innovation

The interoperability offered by cross-chain DeFi technology opens the door to innovative use cases that were previously limited by isolated networks. It includes cross-chain lending, decentralized exchanges that span multiple chains, and diverse financial product integration.

Network Aggregation

Cross-chain technology aggregates the capabilities of different blockchains, allowing users to benefit from the strengths of each network. It can lead to enhanced functionalities, such as combining the security of one chain with the fast transaction speeds of another.

Reduced Dependence on Single Chains

In traditional DeFi, users are bound to the capabilities and limitations of a single blockchain. Cross-chain technology frees users from this restriction. It offers access to a broader ecosystem and reduces the risk associated with being tied to a single chain.

You May Also Like | Cross-Chain DEX for Seamless Interoperability and Liquidity

Top Blockchain Protocols Supporting Cross-Chain DeFi Technology

Several top blockchain protocols are at the forefront of supporting cross-chain DeFi technology, facilitating interoperability, and expanding the possibilities within the decentralized finance ecosystem. Here are some of the notable blockchain protocols that play a pivotal role in enabling cross-chain DeFi solutions:

Polkadot

Polkadot is renowned for its cross-chain interoperability framework. Its parachain architecture allows different blockchains to connect to the Polkadot network, enabling seamless asset transfer and communication between chains. Polkadot's interoperability aims to create a unified ecosystem where various specialized blockchains can collaborate effectively.

Cosmos

Cosmos utilizes the Inter-Blockchain Communication (IBC) protocol to enable secure and seamless communication between different blockchains. This protocol empowers independent blockchains (zones) to connect and exchange data, assets, and value across the Cosmos Hub, fostering a decentralized and interoperable ecosystem.

Avalanche

Avalanche offers Avalanche Bridge, a cross-chain platform that facilitates the movement of assets between different blockchain networks. It leverages the Avalanche consensus protocol and provides developers with the tools to create interoperable blockchain networks. Therefore the blockchain offers new opportunities for cross-chain DeFi applications.

Explore More | Blockchain Bridges | Enabling Cross-Chain Interoperability

Launch Your Cross-Chain DeFi Project

The DeFi market is evolving with the rise of cross-chain technology and several enterprises are keen on launching cross-chain DeFi solutions. Oodles empowers finance firms with trust, scalability, and transparency through cross-chain tech, transforming their core financial operations. If you need a DeFi development company for cross-chain Defi lending solutions, then connect with our blockchain developers today.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.