-

In the fast-paced financial markets, perpetual futures contracts have emerged as a treasure trove of investment opportunities when it comes to crypto exchange development. These contracts, which do not have an expiration date, offer key benefits for traders seeking flexibility and dynamic opportunities.

In this blog, we explore the vast array of opportunities that perpetual futures contracts offer to traders in the fast-paced world of financial markets.

What are Perpetual Futures Contracts?

Perpetual futures, also known as perpetual swaps or "perpetual," are derivative contracts that allow traders to speculate on the future price of an asset without an expiration date. Unlike traditional futures contracts with a set expiry date, perpetual futures are held indefinitely.

Perpetual futures are an increasingly popular financial instrument, especially in cryptocurrency trading, for speculating on cryptocurrencies like Bitcoin and Ethereum. However, they can also be applied to other assets like commodities and indices. They are popular because they allow a greater degree of leverage and may be more liquid than the spot cryptocurrency market.

Perpetual futures trading involves using financial contracts to speculate on the future price of an asset, typically without an expiry date. Here's a breakdown of the key points:

- Speculating on Price: Similar to regular futures contracts, perpetual futures allow you to bet on whether the price of an asset (like cryptocurrency) will go up or down.

- No Expiry Date: Unlike traditional futures contracts with a set settlement date (delivery of the underlying asset), perpetual futures contracts have no expiration. You can hold your position for as long as you want.

- Funding Mechanism: A funding mechanism maintains the price of the perpetual futures contract close to the underlying asset's spot price. This means that traders with long positions (betting the price will go up) might pay a fee to traders with short positions (betting the price will go down) or vice versa, depending on market conditions.

You may also like | How to Develop a Crypto Wallet like Trust Wallet

How are Perpetual Futures Trading and Perpetual Futures Contracts Interconnected?

Perpetual futures trading and a perpetual futures contract are intimately related. Here's how:

- A perpetual futures contract is a financial agreement used in perpetual futures trading. It's an agreement between a trader and the exchange platform outlining the terms of the trade, specifically for speculating on asset prices without an expiry date.

- Perpetual futures trading involves using perpetual futures contracts to place bets on an asset's price movements. In essence, the contract is used as a tool to participate in trading activities.

Also, Read | Customization Options in White-Label Crypto Exchanges

Perpetual Futures Contract Vs. Traditional Futures Contracts

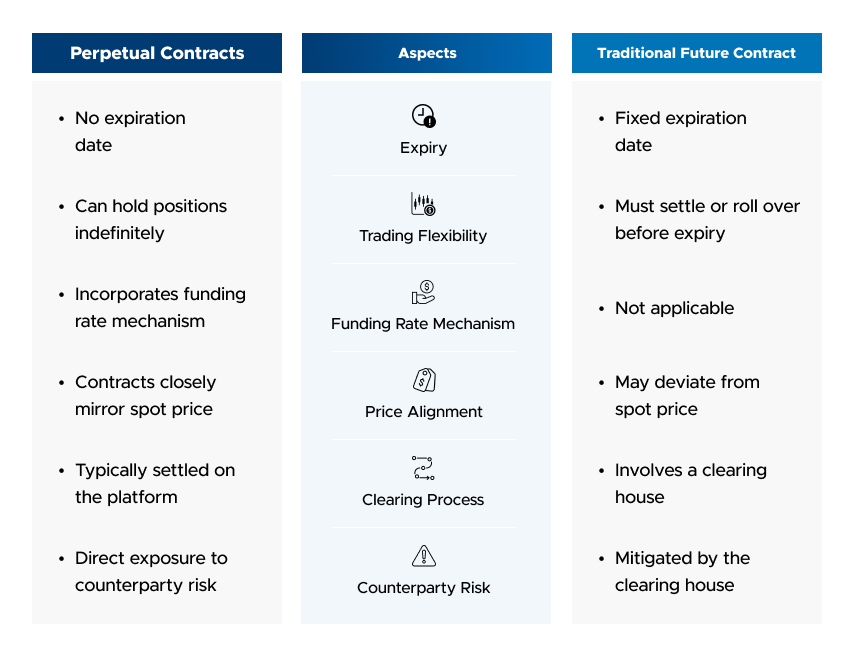

This table highlights the key differences between perpetual and traditional futures contracts, focusing on expiry, trading flexibility, price alignment, clearing process, and counterparty risk.

How do Perpetual Future Contracts Work?

Imagine you and a friend agree on a price for a specific collectible in the future, but there's no deadline to buy or sell it. It is similar to a perpetual futures contract. The funding mechanism acts like an adjustment depending on the collectible's current market value. If the collectible's value goes up, you (the long position) might need to pay your friend a fee to reflect the change.

Perpetual contracts operate through a funding rate mechanism, which plays a crucial role in ensuring that the contract's price remains closely aligned with the spot market price of the underlying asset. This mechanism involves traders paying or receiving fees at regular intervals, depending on various factors such as the contract price compared to the spot market price and the type of position taken (long or short).

When the price of a perpetual contract is trading above the spot market price of the asset, known as trading at a premium, the contract's funding rate is positive. In this scenario, long position holders pay short position holders a funding rate fee. Conversely, if the contract price is below the spot market price, termed trading at a discount, short position holders pay the funding rate fee to long position holders.

This funding rate mechanism aims to incentivize market participants to help maintain the contract's price close to the spot market price. It promotes market efficiency and facilitates price discovery by creating opportunities for arbitrage and encouraging traders to enter positions that earn them funding payments.

Overall, the funding mechanism maintains the price of the perpetual futures contract close to the underlying asset's spot price. Thereby, it contributes to a more efficient and balanced market environment.

Also, Check | Layer 2 Solutions for Crypto Exchange Development

Key Characteristics of Perpetual Futures Contracts

Perpetual futures contracts, a dynamic instrument in financial markets, boast several vital features that make them appealing to traders. Understanding these fundamental characteristics is essential for navigating the world of perpetual futures trading effectively and managing risk in this dynamic market environment.

- Perpetual futures contracts lack an expiration date, enabling traders to hold their positions indefinitely without the need to close or roll over the contract.

- The funding rate mechanism in perpetual futures contracts ensures alignment with the underlying asset's spot price by exchanging rates between contract parties based on the price differential between perpetual futures and spot prices.

- Traders can leverage their positions in perpetual futures contracts to control larger positions with a smaller capital outlay. However, leveraging also magnifies potential gains and losses, demanding risk management.

- Traders must actively manage margin requirements to sustain their open positions. Falling below the maintenance margin threshold can trigger liquidation, automatically closing the position to mitigate further losses.

Explore more | Scratch-Built Vs. White-Label Crypto Exchange Software

How to Trade Perpetual Futures?

To trade perpetual futures, traders must open an account with a cryptocurrency exchange or a platform offering these contracts. After funding their account to cover initial and maintenance margin requirements, traders can choose the contract they wish to trade and enter positions by buying or selling.

However, before diving into trading perpetual contracts, it's essential to have a solid understanding of their mechanics and associated risks. Developing a comprehensive trading plan with risk management strategies, such as setting stop-loss orders and diversifying portfolios, can help minimize potential losses.

Risks to Consider

While perpetual futures offer enticing opportunities, they also carry significant risks that traders must know about. Using leverage can lead to substantial losses if positions move against traders, making risk management a critical aspect of trading these contracts.

Moreover, perpetual contracts are subject to market volatility, resulting in sudden and unpredictable price swings. Traders must closely monitor market conditions and adjust their positions to mitigate potential losses.

Also, Explore | Cross-Chain Swaps | Empowering Crypto Exchange Development

Conclusion

Perpetual futures contracts present exciting opportunities for traders to capitalize on market movements and leverage their positions. By understanding the benefits and risks, developing a robust trading plan, and gradually gaining experience, traders can confidently navigate the world of perpetual futures trading and potentially achieve their financial goals.

At Oodles, our crypto exchange developers can create customized perpetual futures trading solutions for your existing platform or build a new exchange from scratch. Are you ready to take your exchange to the next level?

Contact Oodles today to discuss how we can help you launch a successful perpetual futures trading platform.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.