Defi or Decentralized finance is a financial service that is built over the blockchain to provide a more secure, reliable service than the traditional financial services. Most DeFi applications are built over the Ethereum network, which is the second-largest blockchain network. Ethereum provides more flexibility in terms of the smart contract. Programming Languages like Solidity are specifically designed for creating and deploying such smart contracts. Let's suppose, a user wants to set conditions stating that token will only be sent after a particular time and after meeting certain conditions then this can be achieved through ethereum smart contracts.

Some of the most popular Defi concepts are.

Decentralized exchanges(Dex)

Decentralized exchanges help users to exchange digital currencies for other digital currencies, like U.S. dollars for bitcoin or ether for DAI. DEXs are the most popular type of Defi concept, which allows users to trade cryptocurrencies.

In DEX two principles are involved behind this.

On-chain order book mode

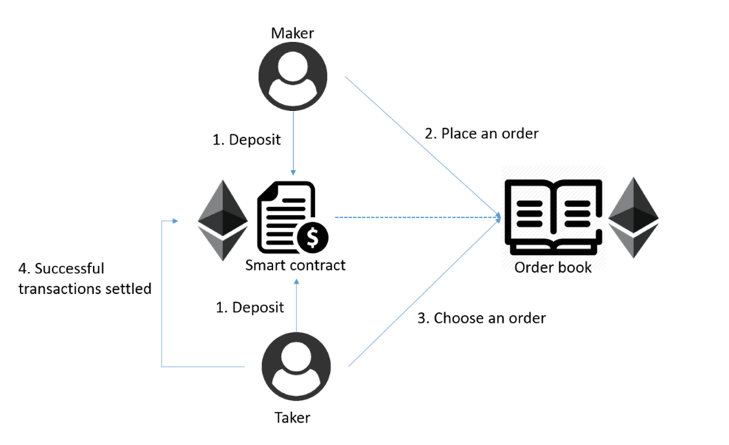

This is the classic way of using the Decentralized Exchange. In this, all functionality is on-chain like recharge, maker, taker, and withdrawal all will happen on-chain. Below is the sample flow diagram to explain this.

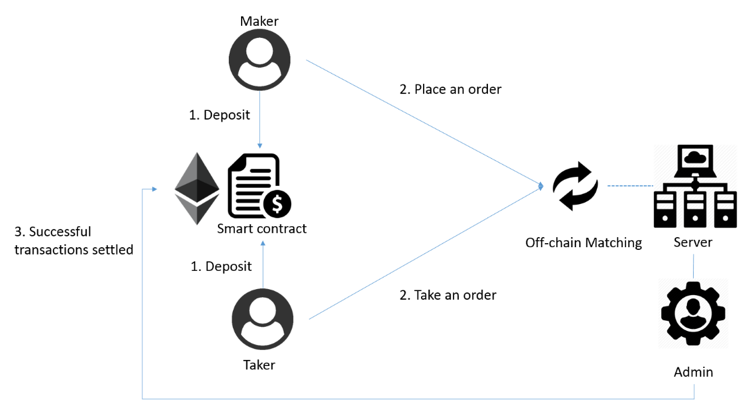

Off-chain order book. This mode takes advantage of both securities of the Decentralized system and the efficiency of the centralized system. Currently, Ethereum Decentralized Exchange IDEX is the representative of this model.

Stablecoins

This platform is used to use external currencies like the Euro and Dollar within the decentralized applications. A cryptocurrency that's tied to an asset outside of cryptocurrency to stabilize the price. The value of digital currencies changes frequently and fiat currencies face various policies and regulations that make the stablecoin best choice for Defi.

"Wrapped" bitcoins (WBTC)

A method to send/using Bitcoin on the ethereum network. This helps the user to use the bitcoin in ethereum Defi. Users can earn interest by lending bitcoin on such platforms.

Lending platforms

By using these platforms the use of intermediaries like banks is removed through smart contracts.

Yield farming

This is one of the new concepts in the context of Defi. Here the users who are willing to take risks can provide their token for farming and will get large returns.

Liquidity mining

These Defi platforms give users some free tokens for using the platform.

Conclusion

Defi implements the concepts of the financial market in a decentralized network. With the help of DeFi, we can create any functionality like the traditional financial platform. But like traditional concepts, it also involves risks. By using these Defi applications, you can generate a passive income by lending money, or use farming for larger returns. Finally, with help of DEX, you can convert your token into any other digital currencies or actual currency.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.

June 12, 2025 at 01:49 pm

Your comment is awaiting moderation.