-

Substantial technological advancements like AI-driven trading bot development are reshaping the landscape of cryptocurrency exchange development. These bots leverage intricate algorithms to scrutinize market data, execute trades, and potentially generate profits for traders. Conversely, OpenAI's language model, ChatGPT, has showcased its prowess in natural language processing and generation. As AI gains ground, a pertinent query arises: Can ChatGPT supplant crypto trading bots? To comprehensively grasp the matter, let's explore the merits and constraints of both approaches.

Comprehending Crypto Trading Bots

Crypto trading bots are software applications equipped with predefined algorithms for executing automated trades on traders' behalf. These bots can process extensive data volumes, track market trends, and respond to real-time market shifts. They are programmable to enact diverse trading strategies encompassing arbitrage, trend tracking, and market making.

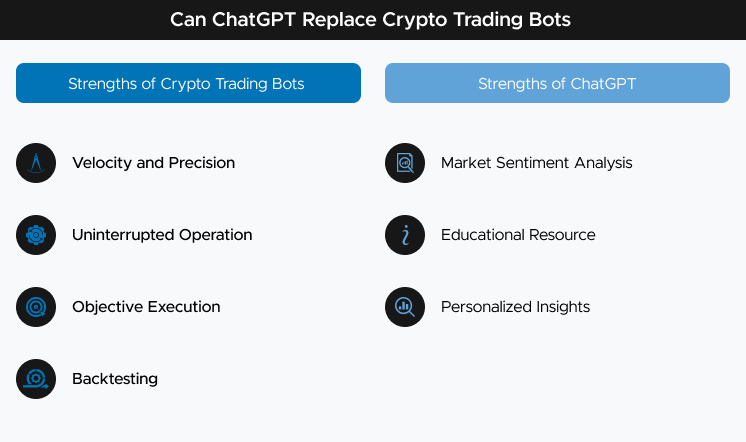

Strengths of Crypto Trading Bots

Velocity and Precision

Trading bots facilitate data processing and trade execution at remarkable speeds, mitigating the risk of missing lucrative opportunities.

Uninterrupted Operation

These bots function ceaselessly, enabling traders to capitalize on opportunities across various time zones.

Objective Execution

Bots adhere to predetermined rules and strategies, devoid of emotional bias, thus promoting disciplined trading.

Backtesting

Historical data aids in backtesting bots, and refining and optimizing trading strategies.

Unveiling ChatGPT's Potential

ChatGPT is a cutting-edge language model tailored to comprehend and generate natural language. While not expressly designed for trading, it can theoretically analyze market news, trends, and sentiment to offer insights to traders.

Strengths of ChatGPT

Market Sentiment Analysis

ChatGPT can dissect social media, news articles, and other sources to gauge market sentiment, potentially impacting trading choices.

Educational Resource

ChatGPT can furnish explanations and educational content about trading strategies and market concepts.

Personalized Insights

It can dispense personalized counsel and insights based on traders' queries and historical data.

Constraints and Contemplations

Despite the strengths inherent to both crypto trading bots and ChatGPT, they each present limitations that necessitate contemplation:

Expertise

Successful trading demands a profound comprehension of market dynamics, technical analysis, and risk management. Neither bots nor ChatGPT can substitute the expertise of a seasoned trader.

Data Quality

Both bots and ChatGPT rely heavily on data quality and accuracy. Erroneous or outdated information can result in flawed decisions.

Unforeseen Events

Unanticipated occurrences, such as regulatory shifts or macroeconomic changes, can exert significant influence on markets. Bots and AI models might grapple with swift adaptation to such circumstances.

Absence of Context

ChatGPT's responses stem from patterns in the data it was trained on and may lack the nuanced comprehension required for intricate trading determinations.

Conclusion

Though ChatGPT has demonstrated its prowess in textual comprehension and generation, it isn't an outright replacement for crypto trading bots. Crypto trading bots are crafted explicitly for market data analysis, trade execution, and risk management, whereas ChatGPT's forte lies in language-oriented tasks. The optimal strategy might involve integrating both technologies. Traders could employ AI models such as ChatGPT to glean insights and context from news and social media while entrusting trading bots with precise trade strategy implementation. Ultimately, the synergy between human expertise, AI analysis, and automated trading is poised to yield prime results within the intricate and dynamic realm of crypto trading.